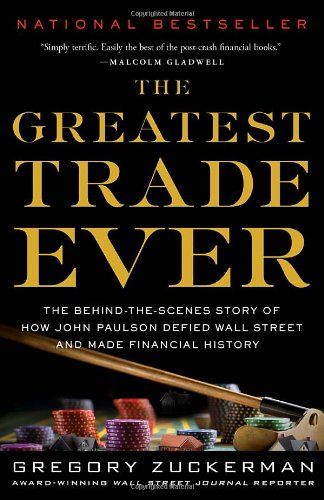

While I was reading this, I actually experienced the anxiety that I experienced when the market tanked. In the book, you get the back story to how John Paulson and other investors bet against the market 2-3 years before the market tanked. As the book goes through the years, I took a moment to think where I was and what I was thinking. Unfortunately, at that time, I fell with the consensus and thought that real estate would always go up. Boy, was the world wrong. Personally, I joined the real estate market at it’s peak and had to find a job related to real estate, but with a salary.

It was a story about adversity. It was a story about how the person to trust the most was yourself. It was a story about doing your own due diligence even though there are “experts” that can help. It was a story about being a contrarian and backing that view with ALL you have, money, power, emotions, etc. All of it was on the line!

To me, the most important part of the book was that it stated amateur investors could have made the trade better than the professionals. The professionals were in their own bubble all listening to the same thing and not part of main street. They were not experiencing what was happening in “real life.” While amateur investors can hear, see, and feel what was happening to their friends and family. They wouldn’t have been able to make as much money as John Paulson, but they would have been right.

I highly recommend this book. John Paulson reminded me of Shakespeare’s quote, “Take Each Man’s Censure, but Reserve Thy Judgement.” This loosely translates to listen to those who criticize, but you should always make your own assessment based on your research and experiences.

Go read it! Be a contrarian! Put your heart in it!