It’s a seller’s market for Triple Net (NNN leases).

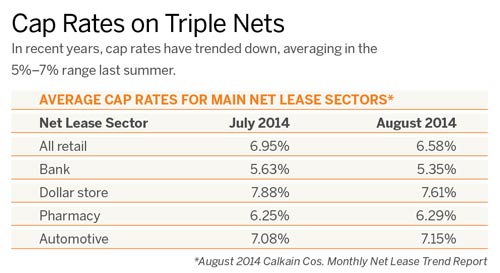

In the article Hunting for NNNs, it states that the reason the cap rates are dropping is due to 1031 exchanges and the quick turnaround they are required to follow.

It even references McDonald’s at a 4% cap rate. I have personally seen McDonald’s cap rates even lower.

The reason triple net leases are so popular is the low maintenance that is required as a landlord. The tenant pays for all of the expenses. In addition, developers can lease at favorable rental rates and still flip the leases to long term investors for a great return from the spread.

It’s remarkable that a lease can add millions in value to a vacant lot.

As the article stated, triple net leases are corporate bonds wrapped in real estate.

Here is a link to the article: Click Here for Hunting for NNNs